Tax Planning

Smarter Strategies. Bigger Savings.

What We Do?

Investment Planning: Design investment portfolios that grow wealth while reducing your tax burden through smart allocations.

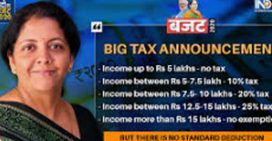

Income Planning: Structure income streams to maximize exemptions, deductions, and rebates.

Tax Optimization: Analyze your financial picture to uncover opportunities to legally reduce tax liabilities.

Tax Planning on Retirement: Plan for retirement with an eye on taxes—pensions, withdrawals, and benefits included.

Business Planning & Tax: Support for small businesses to optimize tax structures, claim deductions, and stay compliant.

Tax Representation: Representing you before tax authorities—professionally defending your interests.